Signals™

The “Check Engine Light” of Financial Wellness

Anticipate your clients’ potential financial weak spots before they occur. Use our award-winning Signals™ feature to quickly indicate a household’s ability to weather up to six common financial events based solely on their Asset-Map Report.

What are Signals?

Signals are mathematical, formula-based indicators that quickly identify a client’s potential funding gaps.

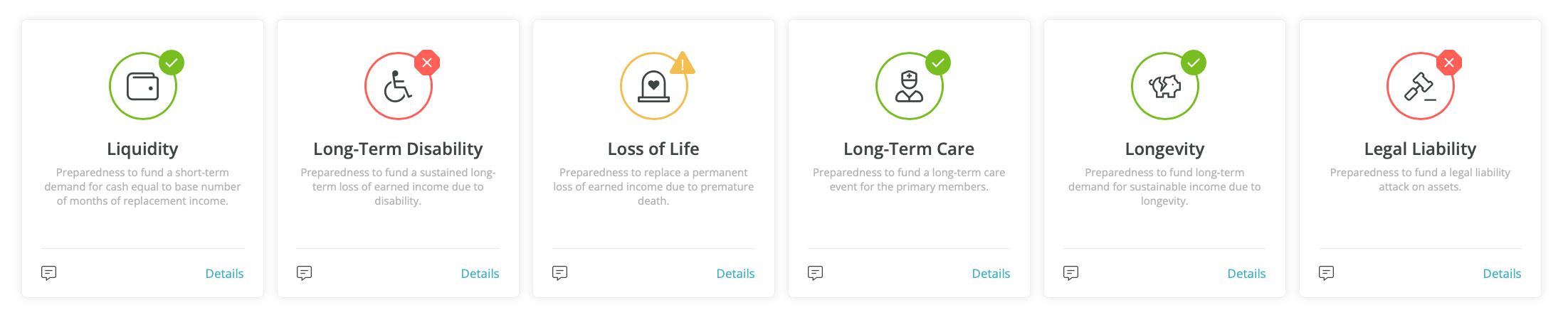

Financial professionals and their clients can see whether there is a potential exposure that needs attention in these six areas:

Liquidity, Long Term Disability, Loss of Life, Long Term Care, Longevity, and Legal Liability.

How are Signals calculated?

Signals use financial industry standard ratios to indicate the current state of financial instruments and their general availability to fund reasonable losses from an event.

Applied only to the “primary members” of a household, each formula calculates the relationship between household income, net worth, and/or insurance base to determine thresholds of exposure revealed in one of three colors: green, yellow, or red.

How do I use Signals?

Use Signals to identify scenarios that are potentially underfunded.

Further inspection may indicate a false-positive or a professional opinion that requires deeper exploration or discussion and next best actions are shown.

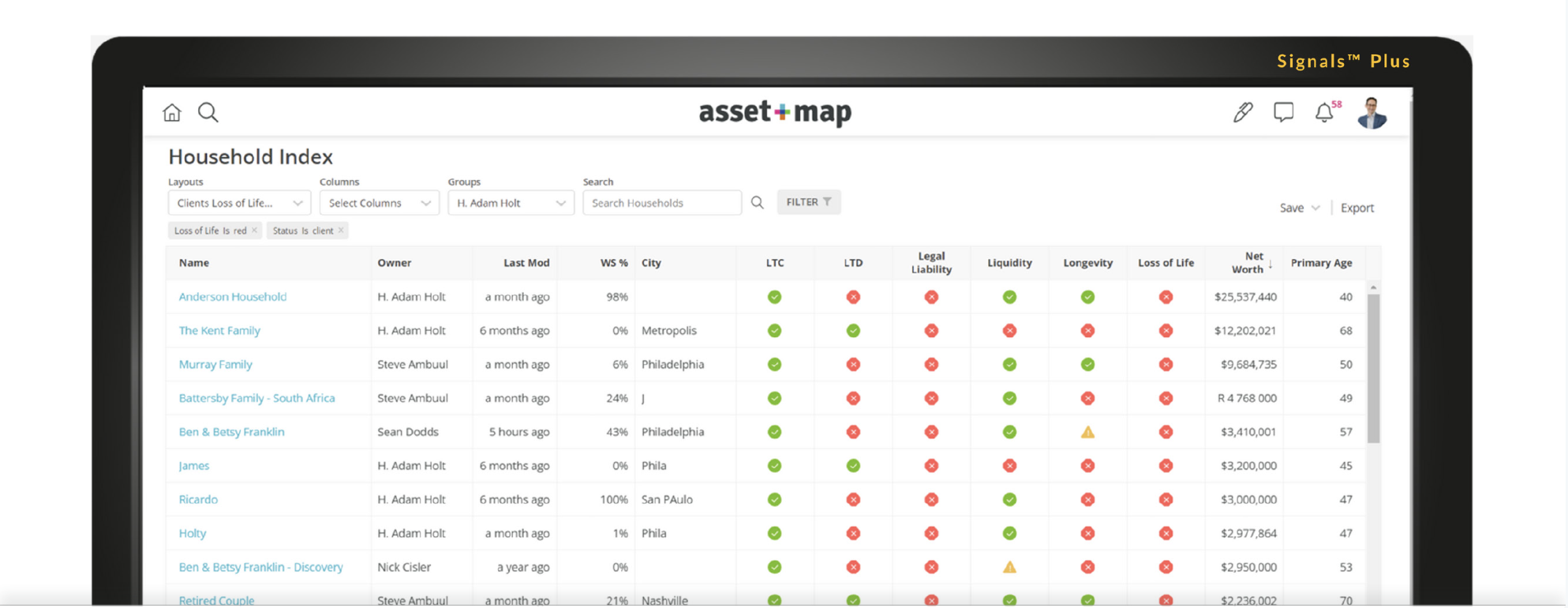

Identify Gaps Across Your Practice with Signals+

What Professionals Are Saying

“Signals are helping our advisors start conversations they just weren’t having before. I expect big things from our firm using this function.”

— David K.

“I was surprised to see how many households we serve still had red Signals. It was an eye opener that revealed an opportunity to deliver more value.”

— Meredith L.

“This is just enough to get our clients to pay attention and ask better questions. We are using Signals to tell our clients first where there may be critical gaps.”

— William C.